Piggy banks and jingling coins were the first things that came to mind when I heard the word “saving” as a kid and a teen. The picture above features the top 14 images from a Google search of the word. Both my early understanding and Google seem to align quite well with the common conception of what savings is – small amounts, several coins at a time, here and there that eventually amount to a useful sum of money. Saving is the essence of wealth creation.

The issue with this understanding is that it makes saving seem like an afterthought. The leftovers. The scraps of consumption. This is the case in the United States where individuals save, on average, less than 10% of their income. For some, this rate even goes subzero. In other words the average person went into debt during the year instead of saving for the future. This hasn’t always been the case though. The average used to be over 15%. Time to bring it back like the mustache.

In fact, financial advisors will tell you, that you should be saving at least 10 – 25% of your income after already having an emergency fund of 3 months to 6 months income set aside in cash.

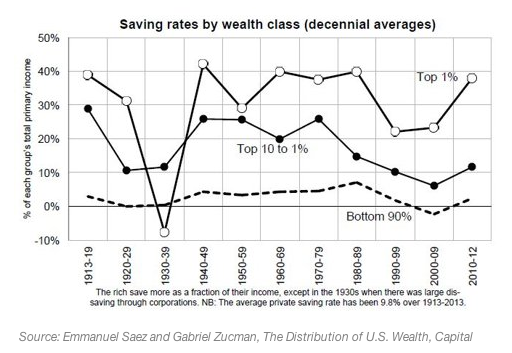

The graph below shows how different wealth groups save. Ironically, the more money you have (money, NOT income – stagnant, piled, cash, money), the easier it is to save. The nature of interest rates (see Interest Stuff posts) makes saving exponentially easier as one’s wealth increases. This is because the money you have produces more money/income and therefore more savings potential.

This exponentially powerful reproductive quality of saving money is what is not explained to young Americans. I did not learn about this manmade phenomenon until I was out of my parents’ house, struggling with bills, and took my first economics course. (Honestly, I would recommend that every single person, at least that plans on living in contemporary society, take basic micro- and macroeconomics courses until they ace them.) When I found out, that you could truly make money with your money through investing, I decided to study business. It seemed the only logical course of study.

I am not saying that people should forego their dreams, major course of study, or whatever to study business. I was, first and foremost, a French major and when it came time to graduate, I walked with the other six French grads instead of with my Business School buddies. I guess what I am saying though, is that the conception of saving as an afterthought, a superfluity is detrimental and should be revised. Saving is a powerful tool that should be aggressively advertised. Too bad it only makes the SAVER money.

Disclaimer: This is not a scholarly blog. I am not citing any sources, rather any information has come from my personal studies and any graphs or data used or referenced is easily accessible via Google Search.